I’m reminded of the classic Alka-Seltzer commercial from the 60’s …Oh What a relief it is … the market is getting better! As I speak with friends, clients and those in the cash register line, I often hear folks delighted to hear the news, which I always couch in the caution “But every Market is different… Where do you live?”

For almost all markets, we have seen a dramatic turn around from the bottom of the market in late 2010… early 2011. For those that haven’t shown improvement, there should be major concern… real improvement may never occur for some markets. It is my sincere hope that this doesn’t describe your market… But some people do own real estate in such markets… There is more than one such market within readership distance of this column!

As the public becomes a bit more excited about or at least at ease with the return of the real estate market, I often hear the complaint that so much value was lost between 2006 and today that they will wait a while longer to recover that loss in value before acting to sell their homes and move on with their lives. While that response is understandable… it may not be well informed.

I can’t think of any better way to communicate an accurate picture of the market and what all the experts (including myself) see as the factors that define the market and what home-owners need to know as they make the decision to Act Now or Wait!

While I realize that the use of charts and numbers may seem daunting, these charts are simple and straightforward in the way they illustrate the dynamics that should influence your decision to act or wait. So let’s begin by looking at your current home.

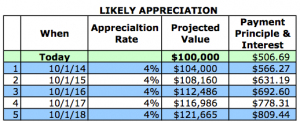

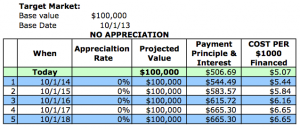

Current Home Likely Appreciation Over The Next 5 Years

The consensus opinion is that we are returning to a normal level of appreciation of real estate. Due to a shortage of homes for sale, the recent appreciation rate has been a bit more than the average appreciation rate of 3%-to-4% per year. However, the norm and expected appreciation rate based on current trends and mid-to-long-term projections is between 3-4%.

Using a fictional value of $100,000 (making it easier to readily translate to your own situation), you can see from the above chart that there is likely to be a considerable appreciation (by recent standards) in home values…

Remember not every market will behave exactly like this… but it’s a good starting point for looking at the likely outcomes. Yes, I know you’ve heard about double-digit appreciation rates… but those are not occurring in our markets… They are occurring in California, Arizonia, Florida and other places that were the hardest hit by the economic crisis. Fortunately, that is not what happened here.

With that projected increase in value, it is understandable that many are shifting into a wait to act mode. But the value of your current home is not the only factor to be considered if your plans include buying another home. If buying another home, there are two other critical factors to consider. What’s happening or likely to happen in your target market for the home you will eventually buy and what is happening with interest rates. To evaluate those factors, take a look at he following charts…

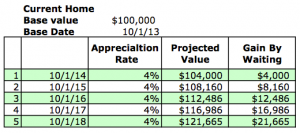

First, let’s look at interest rates. As the market has improved the historically low rates of 3.125 % (sub 4%) are gone… unless you’re looking at an ARM. The interest rate table provided here shows a conservative projection at where interest rates for 30 year fixed-rate mortgages will go over the course of the next few years. Note: The normal rate for 30-year mortgages has been between 7 and 8%

Interest Rates Projections Over The Next Five Years

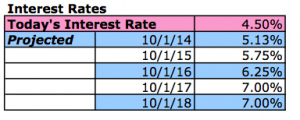

That means the cost of borrowing money is on the way up. Now if you don’t plan on having a mortgage you can ignore this factor… You might want to wait… or maybe not, depending on whether you are moving up or downsizing. Regardless, if you have to borrow money to purchase that new home this is a more significant factor than you may imagine. To illustrate my point, I provide the following chart, based on the value of your new home being static, that is not enjoying the 4% average appreciation rate you will expect on your existing home… Illogical, yes; but bear with me.

Note that the Payments cited above are Principal & Interest Only… Taxes and Insurance are not included.

Notice what happens to your payment over time based solely on the change in interest rates. As they say in the automobile dealership… it’s the payments not the price that is important.

Of course when you move, you’ll probably want to move to a better neighborhood… most people do. Not only will that target neighborhood experience appreciation… It’s possible that it may experience an appreciation rate higher than the 4% we’ve used for your current home. But let’s not stretch numbers to make our point. Assuming an average appreciation rate of 4% and that you won’t buy any more home than you have now… take a look at what happens to price and payments over time.

Now I ask you to be the judge… does it look likely that you will be better off to wait. Does what you will “gain” put you in a better position? Do you want to put off the move to the neighborhood you want to live in… to your new life?

Your choice: Act Now or Wait? Either way, you can now make that choice in a more informed manner.

May the Market be with you.