We are indeed in a housing recovery. One that began in October / November of 2011. Regular readers of this column have heard me speak about this long awaited recovery for sometime. It has taken well over a year of that recovery to be reflected in a convincing statistical way. I’ve been speaking some time now, as well, about a shortage of inventory, rising rents and pent up demand for housing. As these improvements in the market forces have occurred, prices have begun to rise again rather than fall. Good News!

Yes, housing prices are rising and that makes for headlines and concerns by some that we may be looking at another “Housing Bubble!” The question in many minds must be: Is this just another sensationalistic attempt to attract attention or is there in fact a real danger of a new housing bubble?

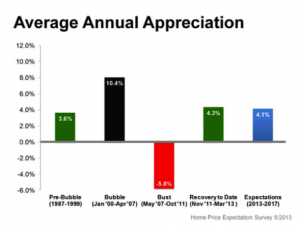

Let’s look at some facts… We are currently experiencing an average appreciation rate of just over 4% annually (historically, a modest yet normal rate of appreciation). See chart below:

I remember well the 10% appreciation rates we expected and in fact experienced during the 1970’s, driven largely by we baby-boomers looking to buy our first home. Never heard anyone call that a bubble! During the early 2000’s (1999-2006), we again saw a dramatic surge in housing prices in an almost totally deregulated market where the financial industry acted as both dealer and player. Again appreciation rates were in the 10% per year stratosphere… Note this is the average rate. There were markets where the appreciation rates exceeded 20% per year, most notably: California Arizona, Nevada, and Florida, the warm and sunny Big Bust States.

Again referring to our Average Annual Appreciation Chart the projected annual appreciation rate in the 4% neighborhood is a return to normal appreciation rates. Will there be some fluctuation in these rates? Surely there will be some modest fluctuations. We may even have brief periods of hyper price increases in certain sectors as supply and demand come into balance again. We are seeing this right now in the Birmingham Market with New Home Prices…

Observation: Much of the appreciation we are currently experiencing is driven by New Home price increases.

With subsidence of market fear paired with pent up demand for housing, actual demand has returned to normal levels. With an increased demand for housing and little desire to tackle the “fixer-upper” projects associated with foreclosures and abandoned properties many have decided a new home is the best/easiest way to realize the amenities/life style they desire. New home construction has seen dramatic increases… but nowhere near the boom level. New home inventories have not been enough to satisfy the resurgent demand and so we have seen some rather dramatic price increases there, due in part to supply vs. demand issue but also to a large increase in construction material costs.

Now this is not bad news for existing home sales. They too will follow this wave of the new housing market and price increases… but not at the same levels of appreciation levels currently being experienced by New Home prices. But then neither will new home prices continue to rise at the same level that we are currently experiencing. Why? Because success is a strong attractant… There will be more competition in the new home sales arena with more builders returning to the marketplace. The governor for that new competition will be the buildable lot inventory… So look for developers to start clearing ground for new Sub-Divisions, another sign of an improved economy.

So is there anything that prevents us experiencing a new Housing Bubble?

The new appraisal standards and regulations set in 2009, while still bemoaned by many of us, are an example of regulation put in place to thwart uncontrolled and unsupported appreciation rates that lead to unfounded bubbles. While in my opinion still under-regulated, financial institutions have nonetheless returned to the sound mentality of NOT making NINJA (No Income, No Job or Asset) Loans… to be sold off to an unsuspecting investor population. Although, it would be nice to see congress put some teeth behind the idea of protecting the market from some of those acts, which lead to the Great Recession.

As to the fear of a new housing bubble… For the foreseeable future an annual appreciation rate of 4 – 4.5% should be expected for desirable markets. Realize that not all markets are equal. Some markets are still struggling… Some are growing at even stronger rates. That does not point to a bubble! But “Danger, Will Robinson”: Should we forget the lessons of the past, all bets are off.

Looking back at the past, it would seem that we may remember these lessons for 20 or 30 years or so… then amnesia or the belief that “this time will be different” seems to set in and we have to learn all over again.

That brings me to a pair of questions: What causes a bubble in any market? Over exuberance! What causes a bust? Fear!

We all have a role to play in preventing Bubbles and Busts. Fight over exuberance… Beware of greed… even when it is our own… Beware of Fear: It rarely leads to the best decision-making. But then I am a contrarian… I believe: When others are selling, it’s time to buy… When they are buying, it’s time to sell…

May the market be with you.