Those of us in the real estate industry often speak of Buyer and Seller Markets and while that may well be a valuable view of a particular market, what may be more important for the market in general is the issue of Housing Affordability. So, what is housing affordability? How is it measured? What does it mean to me?

As with so many of the complex issues in any arena, there is an index or indices to measure that.

The National Association Of Realtors Housing Affordability Index (HAI) measures whether or not a typical family could qualify for a mortgage loan on a typical home. A typical home is defined as the national median-priced, existing single-family home as calculated by NAR. The typical family is defined as one earning the median family income as reported by the U.S. Bureau of the Census. The prevailing mortgage interest rate is the effective rate on loans closed on existing homes from the Federal Housing Finance Board. These components are used to determine if the median income family can qualify for a mortgage on a typical home.

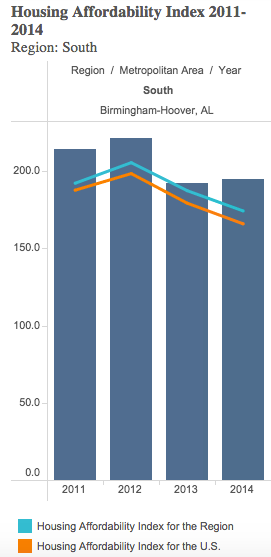

To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.

For example, a composite HAI of 120.0 means a family earning the median family income has 120% of the income necessary to qualify for a conventional loan covering 80 percent of a median-priced existing single-family home.

An increase in the HAI, then, shows that this family is more able to afford the median priced home and conversely as the HAI decreases buyers are less able to afford the median priced home.

Note: The calculation assumes a down payment of 20 percent of the home price and it assumes a qualifying ratio of 25 percent. That means the monthly P&I payment cannot exceed 25 percent of the median family monthly income.

As you can see there are several moving parts to this equation… Home Price, Income, Interest Rate all of which are variable over time and to a large extent location. So the purpose of the HAI is not to indicate an individual buyer’s ability to buy but to understand how the larger market is trending.

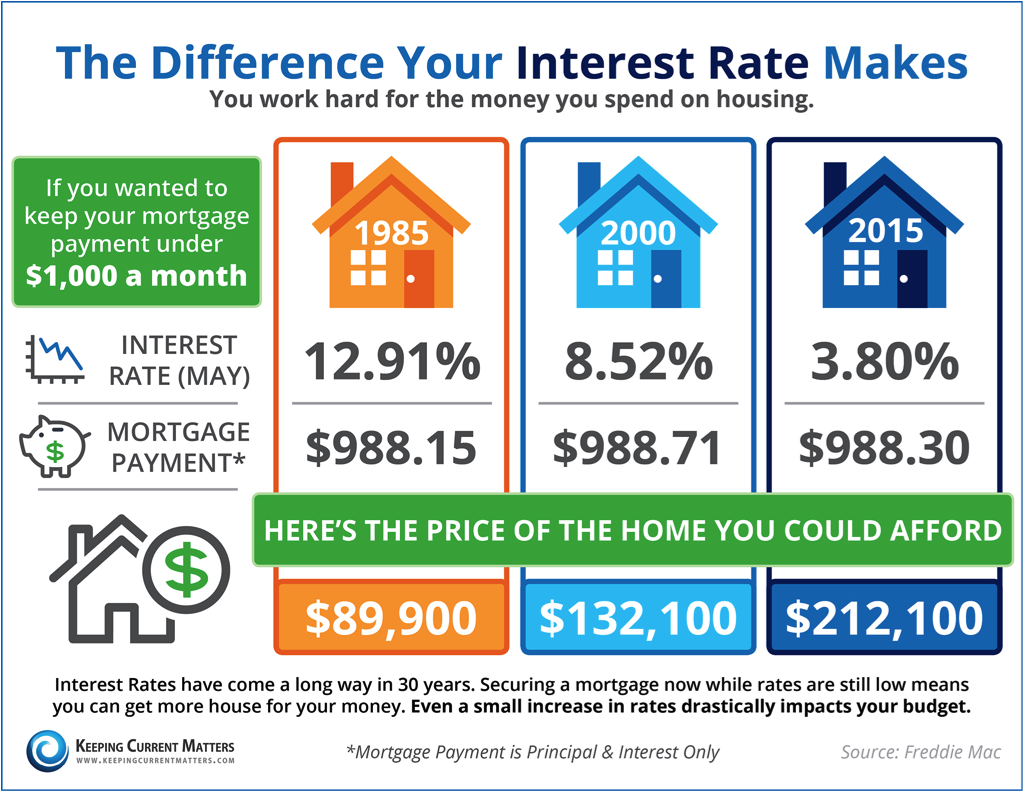

On an individual level you may find it more useful to use the measure of monthly payments to determine how much of a mortgage you can afford. Note that home prices are definitely trending up and have been for over a year. Most of our local markets are experiencing appreciation in the range of 2 – 6% with 4% being the prevalent rate of appreciation. The most critical factor in determining home affordability for an individual being interest rate and of course income. While interest rates have remained at near historic low levels, they have again begun a trend up.

The infographic above depicts the historic impact of interest rates on affordability. As you can see we are at near historic levels for affordability of housing. Yet that number is beginning to decrease from the peak HAI of near 200 to a national HAI around 175 and locally 185. As of this writing, the best interest rates for a 30-year mortgage are 4.08%.

It’s a great time to buy.

May the Market be with you.