The Real Story…

News and commentary about the real estate market and related topics.

Dave Parrish, ABR®, CSP, GRI, ePRO®,REALTOR ®, RE/MAX MarketPlace

The opinions expressed here are my own and don’t necessarily represent those of RE/MAX International.

Is the Mortgage Interest Deduction in Jeopardy? (Part – 2)

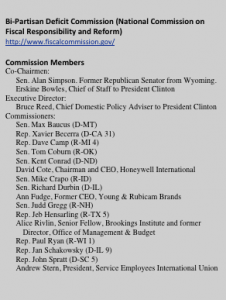

As we discussed last week… the National Commission of Fiscal Responsibility and Reform recently (December 1, 2010) released its recommendations for reform to bring accountability and responsibility to the problem of the national deficit. A portion of those recommendations included suggested changes to the Mortgage Interest Deduction (MID). Now whenever there is a change to the status quo, there will always be a great deal of concern and anxiety. A change to a deduction that has been so widely accepted and exercised will of course be questioned in many ways… and so it should.

As discussed last week, there are some legitimate questions being raised about the effectiveness of the MID in increasing home-ownership… (its primary goal)… and if the reduction in treasury income is being forfeited in the most beneficial way for the economy.

In 2012, the mortgage interest deduction will reduce federal revenues by $131 billion. In contrast, the entire budget for the Department of Housing and Urban Development is just $48 billion.

So is there a better way? Alternatives range from eliminating subsidized mortgages entirely to capping the deduction or converting it to a credit. Each option creates winners and losers. First let’s review what is being proposed. At present, there are several components being suggested on place of the MID.

So is there a better way? Alternatives range from eliminating subsidized mortgages entirely to capping the deduction or converting it to a credit. Each option creates winners and losers. First let’s review what is being proposed. At present, there are several components being suggested on place of the MID.

- 12% Non-Refundable* Tax Credit.

- No Credit for mortgages above $500,00

- No credit for interest on second residence or for HELOC (Equity Loans)

As a citizen first, I can see the merit to such an approach; although, I would suggest some tweaking of the details. First, in the sense of equity and fairness, the limits of the deduction should probably be indexed to local values much as the current FHA Loan limits are set… Case in point: A $500,000 home in Alabama is not quite the same as a $500,000 home in California.

US Median Household Income 2009: $49,777

Median Marginal Tax Rate: 15%

Median Price of a Home: $150,000 (Southern Region)

Is 12% the right level for the Tax Credit? If trying to maintain parity for those most at risk,  those at the lowest income levels, it would seem that a 15% tax credit would be more in line as this would be equivalent to the marginal tax rate for the median household. There are proposals recommending a 20% tax credit. But of course since most below median households aren’t using itemized deductions even the 12% tax credit would be an improvement on the benefit currently received by those most likely to purchase a home due to a subsidy. To lessen the shock of these changes, some phase in program, say over a five-year time period should be considered.

those at the lowest income levels, it would seem that a 15% tax credit would be more in line as this would be equivalent to the marginal tax rate for the median household. There are proposals recommending a 20% tax credit. But of course since most below median households aren’t using itemized deductions even the 12% tax credit would be an improvement on the benefit currently received by those most likely to purchase a home due to a subsidy. To lessen the shock of these changes, some phase in program, say over a five-year time period should be considered.

It wasn’t that long ago that ALL interest was deductible. Car loan interest, credit card interest, etc. In 1986, Reagan signed the bill that eliminated those deductions. People cried that the world would end when they eliminated these tax deductions. It didn’t. As a matter of fact, the amount of debt for the average American has grown substantially until the past 18 months when we have begun to see a modest reduction in debt forced by the economic downturn and reduction in credit extension.

No change is expected anytime soon

The deduction is likely to remain in tact, changed little if at all. For the time being the big winners… the upper-middle-class who own homes, itemize deductions and spend a sizeable amount on mortgage interest. They have considerable political force. Add to that the powerful real estate lobby, mortgage brokers and home-builders. Today, no one wants to deal any more blows to the housing market. Industry spokespersons say that reducing the deduction would hurt housing markets at the worst possible time. “It seems very counter-intuitive to impose this kind of pain on an industry that’s already suffering more than any industry in America,” says Jerry Howard, chief executive of the National Association of Home Builders. For better or for worse, America will continue to be married to the mortgage interest deduction for some time to come.

As a nation, we seem to be oblivious to the impact that the weakened dollar and a loss of confidence by the rest of the world in our ability to exercise restraint and control our deficits will at some point result in the movement of those foreign dollars somewhere else. One thing is for certain, if the congress does not take steps to reduce the deficit, our economic situation will worsen… and when the tipping point is reached, it is highly unlikely that we will be able to turn back the tide. To hold our status as a safe place for the rest of the world to invest, we will have to share in reforms that seem unpleasant departures from the status quo. However, that is unlikely to happen, as we wait almost childishly for the “return of the good ole days.”

May the Market be with you.

___________

* A Non-Refundable Tax Credit is a credit against taxes paid dollar for dollar. Whereas, a refundable tax credit would result in an income supplement (a true subsidy). Current suggestions are for a Non-Refundable Tax Credit.