The Real Story …

News and commentary about the real estate market and related topics.

Dave Parrish, ABR ®, CRSA, CSP, GRI, ePRO ®, REALTOR ®, RealtySouth

Looking back at 2009…

The trash man hasn’t made it by to pick-up the debris left from Christmas yet and 2009 is not yet officially in the history books, even so I feel compelled to review briefly what we’ve been through this year before looking ahead to 2010. My reflections while not without regard to the general economy are of course focused through the lens of real estate.

For the most part regardless of political party affiliation or leanings, I believe most of us were looking forward to 2009 as a year of change… for relief from the banking crisis of September and October 2008 that resulted in the now infamous TARP program, positive employment news, a rebounding of the real estate market, and a sense of renewed hope in the future of the American economy.

Largely a year of waiting… Change has been slow to come… at times almost imperceptible, reminding me of my grammar school science studies of inertia. In the news the last few weeks we have heard that many of the troubled financial institutions that received TARP funds have paid them back. This combined with improved GDP numbers have contributed to recent improvements in the US Dollar Exchange Rate.

The Value of the US Dollar declined to other currencies steadily over the course of the year, but began a recovery in December

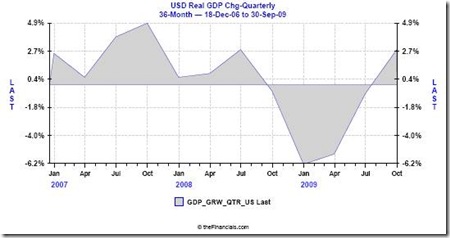

GDP has shown a significant recovery from the precipitous fall in 2008 Q4 with 2009 Q3 showing respectable growth.

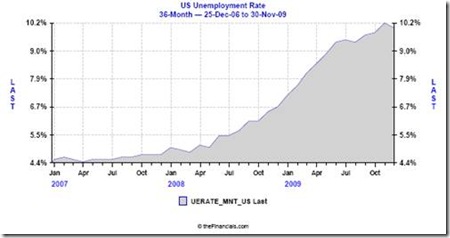

While unemployment is still at unacceptable high levels and fear of further job losses remains with many, the last three job reports have shown improvement … a needed change of direction.

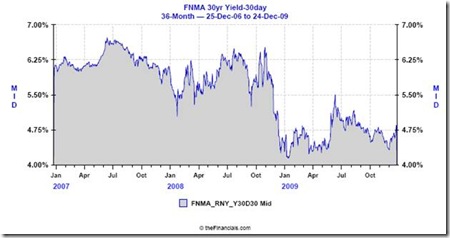

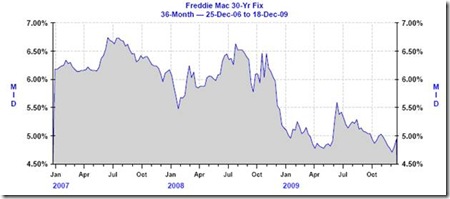

More closely related to the Real Estate Market are long term mortgage interest rates as represented by FannieMae and FreddieMac rates which remain at near 40 year historic lows. As the general economy improves these rates are predicted to rise.

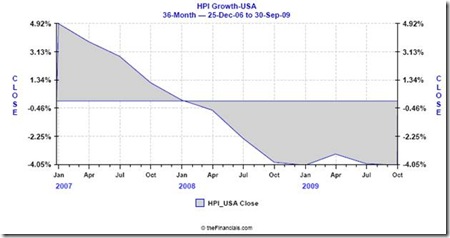

The Housing Price Index (HPI) which tracks appreciation/depreciation of residential real estate market prices reflects a decline (at the national level ) of approximately 4% in market price bringing current housing affordability indexes to the most attractive level in decades.

But remember all Real Estate Markets are local…. And as seen below our market has fared better than most.

Median Sales Price of Existing Single-Family Homes ($000 thousands)

Metro Area 2006 2007 2008 2008.Q3 2008.Q4 2009.Q1 2009.Q2 2009.Q3 %Change

Bham AL 165.1 161.3 153.9 156.1 135.4 130.4 152.3 153.3 -1.8%

U.S. 221.9 217.9 196.6 200.4 180.2 167.3 174.2 177.9 -11.2%

NE 280.3 288.1 271.5 269.9 248.8 235.2 245.8 244.5 -9.4%

MW 164.8 161.4 150.5 158.9 139.5 131.6 146.4 150.2 -5.5%

SO 183.7 178.8 169.4 173.8 156.7 146.6 158.6 160.0 -7.9%

WE 350.5 342.5 276.1 268.0 249.3 229.2 214.2 224.0 -16.4%

Foreclosures:

Prior to 2006 foreclosures were an extremely insignificant share of total market activity and were not tracked separately by the Birmingham MLS. Effective with 2009 statistics the MLS Statistics have tracked foreclosure activity. Year-to-date foreclosures have represented approximately 25% of the real estate transactions. Even so Alabama has a favorable (as compared to other states) foreclosure rate

Local Market Data

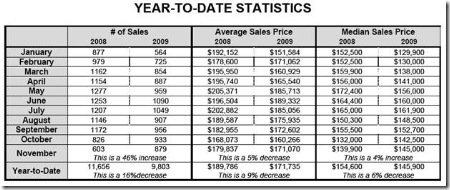

Good News: Total Birmingham area home sales increased by 46% in November 2009 compared to November 2008. Total November sales were 879 compared to 603 in November 2008.

This significant increase in total sales can be attributed to what was happening one year ago with the presidential election and the Wall Street crisis. Congress had just moved to bail out financial institutions. Home buyers became jittery by all the uncertainty and dropped out of the market in droves.

As we consider economic conditions from a year ago it is encouraging that November home sales have increased.

More Good News: The median price in the Birmingham area increased by 4 percent in November 2009 compared to November 2008. The November median price was $145,000 compared to $139,900 in November 2008.

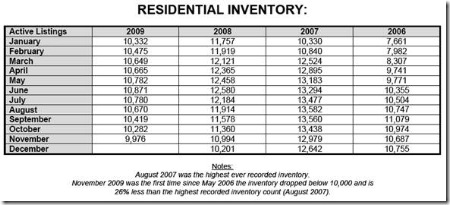

Residential inventory continues to drop. Current levels are 26 percent lower than the highest ever recorded back in August 2007. Also note inventory is at lowest point since May 2006.

Local Inventory Levels have begun to reduce.

To summarize, it appears that we may have reached the bottom of the real estate market. This is further signaled by the doubling of investor transactions occurring in the third quarter. At this point improvements have been modest and it is unlikely that further improvements will be more aggressive. However, as the market does improve interest rates are likely to rise decreasing overall housing affordability. Or perhaps more succinctly: It appears 2009 was the beginning of the end of the real estate market crisis while 2010 looks to be the beginning of the recovery, albeit a slow one.