The Real Story…

News and commentary about the real estate market and related topics.

Dave Parrish, ABR®, CRSA, CSP, GRI, ePRO®,REALTOR ®, RealtySouth

The opinions expressed here are my own and don’t necessarily represent those of HomeServices South.

Next…

Let me begin with the statement: ALL Real Estate Markets are Local!

Having said that, those local real estate markets are not unaffected by the larger market and national trends. As a matter of fact, being aware of those trends can be useful as we look to the future.

Now don’t take this wrong, Birmingham is after all my chosen home as well as my birthplace; however, Birmingham is not known as a market leader or a trendsetter. But that’s not news… We rarely experience the highs or the lows of the markets. However, the delayed after shocks of those extremes are felt here… and that my actually be an advantage that we have over those trendsetting markets!

California is a very different environment than Alabama. It is a trendsetter… suffering both extremes of mountain top highs and Death Valley like lows. As we watch the upheaval of those great changes from a distance, there are lessons to be learned. The buffer of time to examine what is going on elsewhere can be used to prepare for the coming bust or boom. What’s coming next?

The California market for example has been in the news a great deal over the course of the last four years. One of the first markets to see the foreclosures crisis and market declines, for the past 12 months things have begun to stabilize a bit in that hot bed of trendsetting.

Could this be an early signal that the market will get better? Or is there more to the story?

On the national scene, as a whole, the biggest issue appears to be something called “Shadow Inventory.” In simple terms “Shadow Inventory” describes foreclosed properties currently owned by banks (or that will be owned in the future) that are sitting empty and are not currently for sale. According to the Wall Street Journal calculations it would take 103 months -that’s 8.5 years- to sell all the foreclosed property.

JPMorgan Chase, Wells Fargo and Bank of America… each hold more than $20 Billion in Foreclosures … $2 in Pipeline for Every $1 of Loans Already in Foreclosure

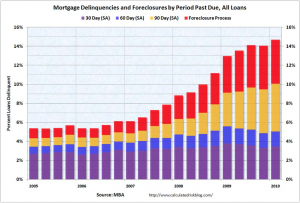

According to new data released last week, the nation’s largest banks are holding enormous volumes of distressed home loans. According to an analysis by Weiss Ratings (October 22, 2010 www.weissratings.com), JPMorgan Chase, Bank of America, and Wells Fargo each reported more than $20 billion in single-family mortgages currently foreclosed or in the process of foreclosure as of midyear. In addition, Weiss found that for each dollar these banks held of mortgages in foreclosure, there were an additional $2 in loans in the pipeline that were 30 days or more past due.

Among all U.S. banks, JPMorgan Chase has the largest volume of mortgages in foreclosure or foreclosed with $21.7 billion. On top of that, the company has $43.4 billion more in mortgages past due.

Compared to JPMorgan, Bank of America has a somewhat smaller volume of foreclosures – $20.3 billion – but it has a larger pipeline of past-due mortgages at $54.6 billion. Wells Fargo’s foreclosures come to $20.5 billion, with $48 billion in overdue home loans.

This overwhelming number of foreclosures properties yet to enter the market points to a continuation of market pressures on a national level.

It would appear that we are in for a continuation of price erosion on the market. The consensus is that will continue at least through the end of 2012. However, the Shadow Inventory problem seems to point to an even more protracted period of decline.

Currently in the Birmingham market 1323, just over 10% of the 13035 homes on the market, are foreclosures. This number does not include those homes on the market that are classified as short sales. However, almost 34% (33.96%) of the homes sold in the last 12 months were foreclosures i.e. 4,329 of the 12,749 homes sold. Pending sales (those homes currently under contract but not yet closed) is 38.59% foreclosures or 362 of the 938 pending sales.

www.calculatedriskblog.com

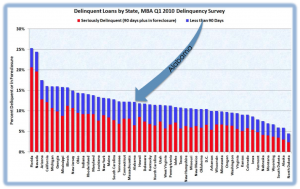

Delinquent Mortgages by State are depicted in the chart above.

While I have searched diligently to get at raw data for these foreclosures yet to appear on the market (i.e. the Shadow Market) especially as related to the local market, I have at this writing been unable to locate that data. The question I want to answer is: What is the number of homes in that shadow inventory category (1) for Alabama then (2) by local market area(s). Is Alabama in better or worse shape than indicated by the national trends?

So what does this mean: If you have a reasonable expectation that you will have a legitimate need to sell your home in the next 10 years. Now may be the time to do so. At the same time, I would discourage anyone from selling or putting their home on the market without this legitimate need to do so, as it would create even greater market pressure for those who truly need to sell.

May the market be with you.