Next…

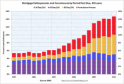

This overwhelming number of foreclosures properties yet to enter the market points to a continuation of market pressures on a national level.

It would appear that we are in for a continuation of price erosion on the market. The consensus is that will continue at least through the end of 2012. However, the Shadow Inventory problem seems to point to an even more protracted period of decline.

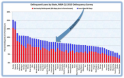

Currently in the Birmingham market 1323, just over 10% of the 13035 homes on the market, are foreclosures. This number does not include those homes on the market that are classified as short sales. However, almost 34% (33.96%) of the homes sold in the last 12 months were foreclosures i.e. 4,329 of the 12,749 homes sold. Pending sales (those homes currently under contract but not yet closed) is 38.59% foreclosures or 362 of the 938 pending sales.

www.calculatedriskblog.com

Delinquent Mortgages by State are depicted in the chart above.

While I have searched diligently to get at raw data for these foreclosures yet to appear on the market (i.e. the Shadow Market) especially as related to the local market, I have at this writing been unable to locate that data. The question I want to answer is: What is the number of homes in that shadow inventory category (1) for Alabama then (2) by local market area(s). Is Alabama in better or worse shape than indicated by the national trends?

So what does this mean: If you have a reasonable expectation that you will have a legitimate need to sell your home in the next 10 years. Now may be the time to do so. At the same time, I would discourage anyone from selling or putting their home on the market without this legitimate need to do so, as it would create even greater market pressure for those who truly need to sell.

May the market be with you.

Page 2 of 3 | Previous page | Next page