Our youngest child is frustrated, exasperated and disappointed. In the past three weeks he has put offers in on 5 houses… Four of the five went “Highest & Best”… another went under contract with no opportunity to re-bid. In the four cases that went Highest & Best, he did re-bid. His re-bid offers were 8-10% higher than the list price. He hasn’t been the highest or best in any of these bids. He is submitting a Highest & Best on a sixth home this morning.

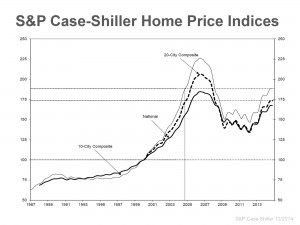

All of this is taking place in South Florida (St Petersburg), one of those horribly distressed markets that served as a harbinger of the economic period we have come to call the Great Recession.

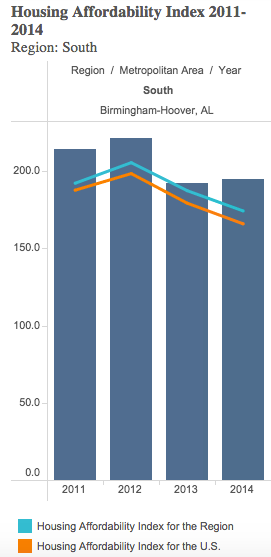

As I’ve reported previously, the most common question I am greeted with is: “How’s the market?” My standard response; “Well that depends on where you live.” You see: All real estate is local! But I can tell you that the call for Highest & Best is all too common here as well in the tri-county area making up the bulk of the Greater Birmingham Market. As I write this, I am waiting on a response to a Highest & Best offer. Some areas (markets) of course have more than others. It’s all matter of supply and demand.

While this law of supply and demand has been with us for eons, those three words are too oft glossed over… their meaning not fully understood. While supply and demand might be reduced to an equation where the components are thought of as equals, nothing could be further from the truth. Experience has taught me that demand is key, if not king! Without demand, supply is meaningless… it’s dividing by zero.

With that in mind, it is useful to understand what creates or impacts demand. In the world of real estate those factors include: (spoiler alert) Location, profile (major features), condition, amenities, price. That is, what are potential buyers looking for. It is the balanced but considered combination of these factors that create individual action taking demand… that point on the demand curve that causes action to be taken. Ignoring or improperly weighting any of these factors is to miss-gauge demand.

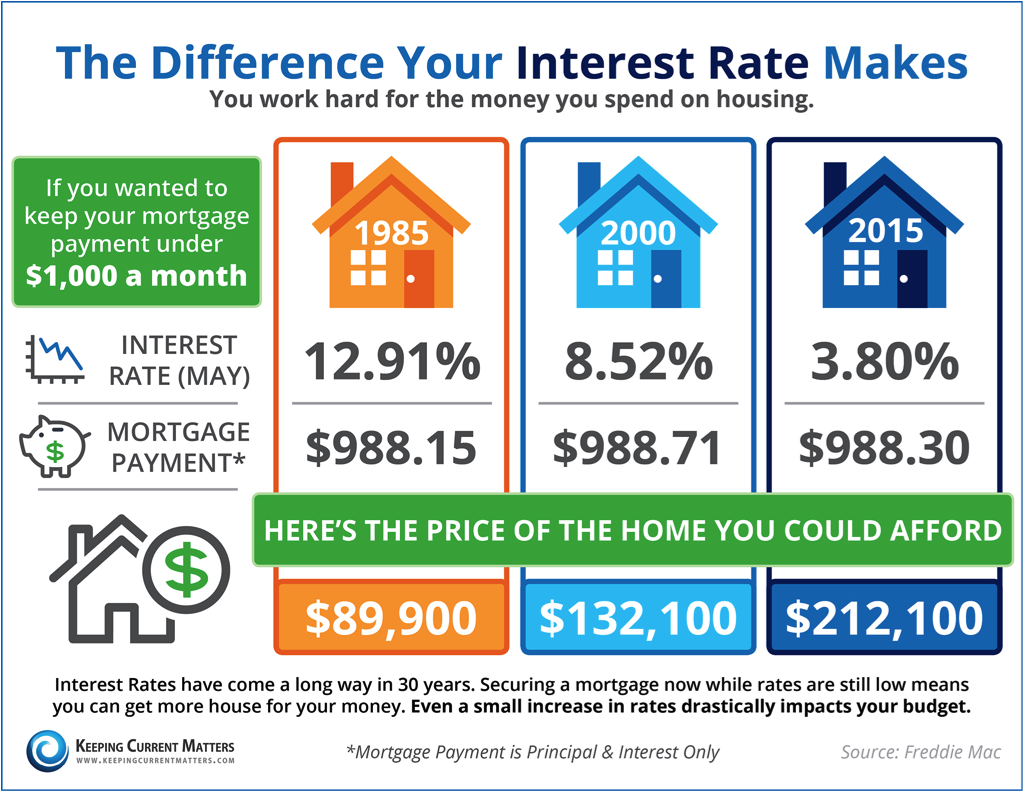

Lest I be accused of ignoring the impact of supply, it is fair to say that supply finds its meaning by comparison to demand. The role of supply is to measure competition and is to be considered in pricing. While supply may impact price, it does not define demand. High supply may be the result of low demand or it could be the result of some other external factor that is not related to a specific property or market, for example high interest rates, a change in requirements to obtain a mortgage, or other factors may result in a high supply even when demand is high. Although, those factors could also be said to reduce demand… it is usually more accurate to say they disrupt the market.

Understanding Supply and Demand is much more complicated than the months of inventory for sale… it’s understanding the market.

May the Market be with you…