While celebrating this Independence Day, it seems appropriate to reflect on what it means; yet, I always find it difficult to write about special events and holidays. It seems that all that needs to be said has been said… that any feeble attempt to contribute more somehow tends to minimize rather than magnify. Yet here I am writing on that day so close to our hearts regardless of race, religion, color, ethnic origins, and yes even politics… the celebration of the birth of a nation… and perhaps more importantly the birth a dream.

James Truslow Adams coined the term “American Dream” in his 1931 book The Epic of America. His American Dream is “that dream of a land in which life should be better and  richer and fuller for everyone, with opportunity for each according to ability or achievement. It is a difficult dream for the European upper classes to interpret adequately, and too many of us ourselves have grown weary and mistrustful of it. It is not a dream of motor cars and high wages merely, but a dream of social order in which each man and each woman shall be able to attain to the fullest stature of which they are innately capable, and be recognized by others for what they are, regardless of the fortuitous circumstances of birth or position.”

richer and fuller for everyone, with opportunity for each according to ability or achievement. It is a difficult dream for the European upper classes to interpret adequately, and too many of us ourselves have grown weary and mistrustful of it. It is not a dream of motor cars and high wages merely, but a dream of social order in which each man and each woman shall be able to attain to the fullest stature of which they are innately capable, and be recognized by others for what they are, regardless of the fortuitous circumstances of birth or position.”

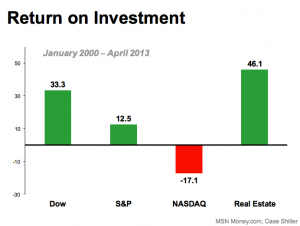

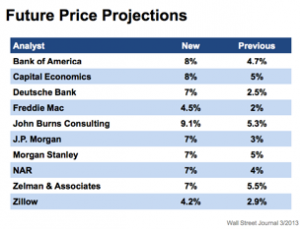

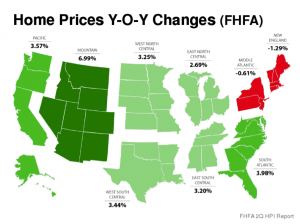

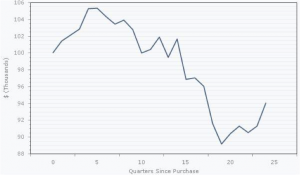

For decades that dream has often been epitomized by the dream of homeownership; however, for the past six-to-seven years that form of the American Dream has been brought into serious question. The basis for that re-examination of homeownership was its ability to contribute to increasing equity or wealth for the working class citizen… the common man.

At this juncture, it seems that the equity crisis in homeownership is correcting as the market turns, which is of course welcomed news. However, the contribution of homeownership to realization of the American Dream extends far beyond wealth building.

Homeownership is at the core of the American culture… an expression of our innate desire for freedom. The ideals of our American independence extend beyond the freedom from tyrannical rule or taxation without representation and into our daily pursuit of happiness, which includes such seemingly mundane choices as the color of our houses … inside and out, whether or not we can have a pet and what that non-human companion may be, to put a nail in the wall so that we can display that reminder of the past or to hang that motivating symbol that inspires us toward our chosen future.

It was that connection to the idea of having our own plot of land where we control our destiny that drove those who came before us through the fears of the unknown wilderness toward new horizons… a place to raise our families, to build a tradition and a history that we could pass along to those who follow… a place to build communities, a place to call home.

Can you imagine an America made up of a nation of renters? Would it be the same America?

So as we reflect on this holiday and celebrate the sacrifices of those who came before us to create our ideal of liberty and freedom for all, I am mindful that having a place to call home is among those unnamed treasures that has been won and preserved through the sacrifice of many.

Happy Fourth of July! May all in your home join in the pursuit of happiness… the American Dream.

May the market be with you.