Resuming our conversation “Why Buy…”

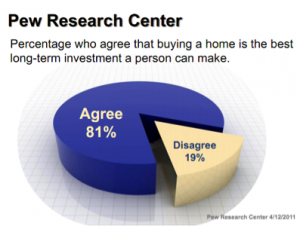

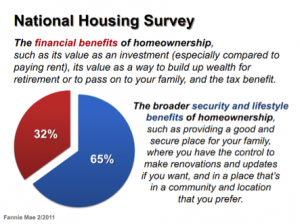

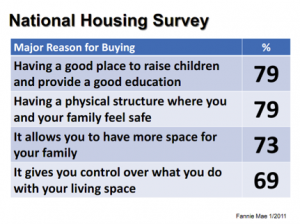

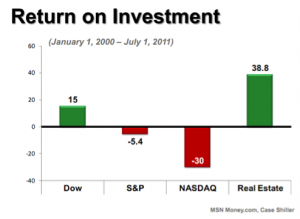

Last time we documented that the driving reasons for the purchase of a home aren’t all about price or even financial considerations. Even so, we would be remiss not to consider the financial aspects of the decision to buy. We documented additionally, that despite the current fall in real estate values, real estate has out performed the Stock Market over the course of time even the tumultuous recent past beginning January 1, 2000… and that did not include the recent declines in stock prices occurring the first part of this month. Taking that decline into consideration gives Real Estate an even more “glorious” track record…

We also established that just like day trading, short-term real estate investment is not for the feint of heart or the casual / uninitiated investor. I’ll speak more about flipping and investing in a future article. True enough; there was a time when it was a sure thing almost regardless of what you purchased. Now that day is gone; and, buying smart is paramount, as it should have always been.

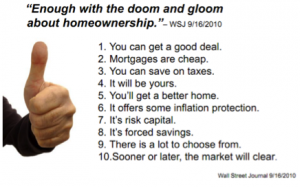

Even so, it’s about more than price. To me, the financial decision really comes down to those of quality and costs… the quality of the investment and the cost of the investment.

First Quality! The first thing in selecting any investment should be the quality of the investment… In real estate this can be summed up as location. No other attribute impacts the value of real estate as location. Location determines the potential for a property to perform in the future. And yet all too often, I see buyers make their decisions to purchase based on easily changed property characteristics, such as room color or whether the yard is shady or not … all the while seeming oblivious to location. True bargains are based on quality versus cost!

Cost: Please understand price and cost are not the same thing! The cost of money is another factor of the cost of an investment. Granted if you’re paying cash you may not feel that cost so directly (even though it’s still there). But most homeowner’s are not paying cash… they’re borrowing the money!

Yes the FED just committed to keeping interest rates low for the next two years. But the truth of the matter is that the FED discount rate and the yield on T-Bills aren’t the only things that determine consumer interest rates. At today’s nominal rates (4.25% for a 30 year fixed rate mortgage) expect a rise to 5.5% interests (not out of the question 12-18 months out). A 1% rise in rates above the current rate of 4.25% represents an increase in the monthly payment (P&I) for a 30-year fixed rate mortgage of 12.15% of $59.59 per month on a $100,000 loan amount.

If we assume the drop in home prices for the next 12 months will be 6% (the number forecast by various sources vary between 4% and 8%) and the interest rate increases projected do occur… let’s say 1% to 5.25%, our increase in cost (Principal & Interest) would be a 5.4% increase in cost. So to absorb the likely increase in interest rates (1%), values would have to drop at least 11% to retain the same payment (monthly cost). No one is predicting price declines in this range for the Metro Birmingham Market or anywhere close to that for anything but the most depressed Alabama Markets.

So you don’t believe interest rates will rise 1%! To manage even a .5% increase in mortgage interest rates, prices would have to fall at least 5.75%! So what is the rate of decline in the market where you would like to buy a home?

These scenarios assume that there will be no inflation. So how does inflation impact these costs?

While I’ll not go into the subject deeply here, inflation puts pressure on interest rates (causes them to rise) because future dollars are worth less than today’s dollars. Inflation also tends to have a greater impact on new home prices than existing home prices… so it’s effects aren’t felt evenly across the board when it comes to home prices. Even so, inflation has a tendency to push home prices up but not necessarily at the same rate that it is occurring due to market forces (supply and demand). In a word inflation is not good for those sitting on the sidelines.

At the present we are experiencing an inflation rate of 3.6% with all indicators pointing toward much higher rates in the future. A major impact inflation will have on the market in the current economic environment is driving up rents. Some of you may be old enough to remember the rent controls that went into effect in the 70’s when inflation rates approached the 12% rate. Or the 20% interest rates for home mortgages in 1980 when inflation was running at the 14-15% range.

Home ownership is a definite hedge against inflation! And yes… Despite the media… Now is a great time to buy! But buy smart… get the help of a reliable and professional counselor/advisor helping you make a truly informed choice.

May the market be with you.