Why buy… (Part 1)

It seems that whenever anyone mentions real estate the conversation immediately turns to the financial aspects of buying a home. Where are prices headed? Where are interest rates headed? Is now the time to buy? Should I wait to try and get a ‘better buy’? Should I wait until I can get a ‘steal’?

The funny thing about all these questions is that survey-after-survey confirms that price is not the reason families actually buy a home.

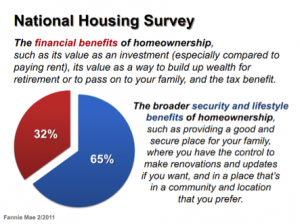

When money is considered at all, it is in light of not paying rent to a landlord. Let’s look at two recent surveys as examples:

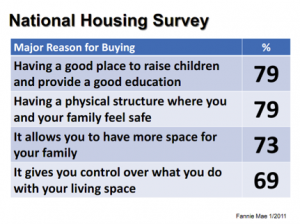

The top five reasons given in the survey for buying a home, in order, are:

- It means having a good place to raise children and provide them with a good education

- You have a physical structure where you and your family feel safe

- It allows you to have more space for your family

- It gives you control of what you do with your living space (renovations and updates)

- Paying rent is not a good investment

The Myers Research and Strategic Services Survey

The top five reasons given in the survey for buying a home, in order, are:

- Home ownership provides a stable and safe environment for children and other family members

- Home ownership means the money you spend on housing goes towards building equity, rather than to a landlord

- Home ownership creates the opportunity to pay off a mortgage and own your home by the time you retire

- Home ownership creates the opportunity to live in a neighborhood that you enjoy

- Home ownership allows you the right to decorate, modify and renovate your home as you see fit

And yet price dominates our conversation when we talk about buying a home. However, when it comes down to it, we actually buy for the same reasons our parents and grandparents did – we want a better lifestyle for our families and ourselves.

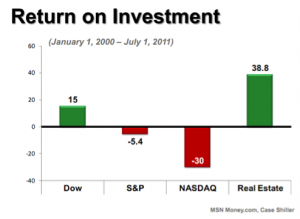

Despite the precipitous fall in real estate values that has occurred over the past five years, real estate has still outperformed the stock markets. It seems that what has really happened is that the “sure-thing” mentality derived from years upon years of appreciating values lured the public into an unrealistic expectation of non-stop appreciation… no-risk gain. As with all markets, there will be ups and downs… Real estate is no different from any other investment in that regard. Even so, when you look at true performance year-over-year, it has out performed most other investment options available to the general public.

Now I don’t want to discount the financial reasons to buy… It’s just that they aren’t the major reason for buying. Even so, let’s take a look at what the record actually shows about the value of real estate as an investment and what the financial experts have to say.

As the Oracle of Omaha, Warren Buffett, believes and does… He buys to hold. He looks at the intrinsic value of any option before investing his hard earned cash and then buys to hold for the long-term. He shuns the short-term view, as should most investors. The short-term, often highly dependent on market timing, will always be higher risk and require greater skill (and perhaps luck) to be successful.

I’ll continue this discussion in my next column… until then…

May the market be with you.