Real Estate as an Investment…

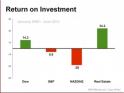

I recently made a post of FaceBook that included the graphic below, which points out the truth about the viability of the Real Estate Market over time (from January 1st, 2000 thru June 1st of 2012) as compared to other leading/dominate investment channel indexes.

I received from a good friend the following response: “C’mon… houses are getting foreclosed on all over, because borrowers owe more than the structure is worth. I am a bit skeptical of this graph.”

My response follows: Ah… But the chart is accurate! When compared to the value of each investment area’s growth since 2000 (pre-bubble) to it’s current value (June 1st 2012) Real Estate did outperform other investment channels shown!

Do not confuse that with the pain that people are suffering because of bad decisions which include the use of HELOC (Home Equity Line Of Credit) Loans and re-financing to rob themselves of their home’s equity, the use of ill advised finance instruments: Interest Only Loans, ARMS, Balloon Notes, etc. when they were the wrong choice for the purchaser’s situation …

If you are comparing current real estate values to their value at the height of the bubble (late 2006 in most markets) it is certainly true that homes are worth less today than they were then… However, that is not what this chart measures… it goes back to 2000 to begin this comparison.

One of the big problems inexperienced investors have is that there is no such thing as a market or investment that only goes up… We as a people were lulled into believing that real estate was an exception by more than 60 years of values rising with few exceptions that were minor hiccups. We have at last finally seen that the principle of the ups and downs of markets do apply even to real estate.

Like other markets, there’s a time to buy and a time to sell. Buying when market exuberance disregards proven forces (when prices are soaring) is not generally the best move one can make. Selling when everyone is scared to death and panicking is an equally poor choice. However, one that some cannot avoid due to their personal circumstances and desires.

Even so, over time there has been no more sound investment for the average man than real estate. Despite, the current situation this is still true…

In the past it almost made no difference what real estate you invested in… That is no longer true! Today’s buyer must be smarter… must use real expertise in his or her purchases of real estate. Smart and well-informed buyers have always done better.

Now is not generally the best of times to sell, but if you must sell in the next few years you will generally be better off selling sooner than later… for the market is still falling although not as fast as it was… Conversely, with prices at well-adjusted values from the unreal exuberant levels of 2004-2006, it is a great time to buy…

Those who realize the truth of buying low and selling high and buy with a sound strategy and the ability to hold will see the power of the Real Estate Market work for them in much kinder fashion than the stock markets… which was the point of the chart.

Also note… Foreclosures are not the result of declining home prices… Foreclosures are a significant cause of declining home prices.

Foreclosures are caused by the Mortgagee not living up to the contract they signed with the Mortgagor… Most commonly: Not making their payments, not properly caring for the property, not keeping insurance enforce, etc.

Now there may be justifiable reasons these things did not happen.

The fact that someone was foreclosed on doesn’t make him or her a deadbeat or an otherwise person of lessened integrity. Bad things do happen to good people…

Page 1 of 2 | Next page