The market has improved markedly! That’s right the Real Estate Market has been improving steadily now for almost 10 months!

Are we at 2006 levels? No! Is it a new boom? No! Are prices increasing? No!

So then what’s so great about the market that you would say it has improved?

The parachute has opened!

This decided improvement in the market is a combination of several factors… Which is a really good thing! One factor improving doesn’t make for any real improvement… Even a couple of factors can be taken as a hiccup. Be when several factors trend positive for as long as we have seen these improvements, there are certainly signs for at least a cheer, if not a celebration.

While we look at our homes with a great deal of emotional attachment… Real Estate, as any market, is a supply and demand issue. Supply and demand are the first two critical factors that we look at when measuring the market. Lower Supply and Higher demand are positive factors when desiring an increase in prices (or a slowing of price decreases).

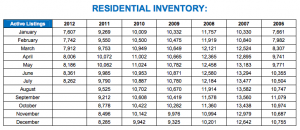

On the supply side: The Birmingham Metro Market has seen a decided decline in the number of properties for sale… Given equal demand this translates to more competition for homes, which would make prices trend higher.

This would obviously beg the question: So what is the demand?

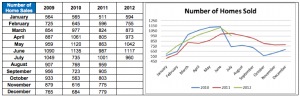

While July sales were not at their highest level of the past 3 years (Remember 2009 & 2010 were both years in which we were offering home buyers a tax credit to buy a home… $6,000 and $8,000 respectively… those credits ended in June of 2010) the sales rates are at very respectable levels, only 4% off of last year’s pace while supply was off by 16%. The real measure is demand compared to supply. The ratio for these two factors is the strongest we have seen (for the past 6 to 10 months) that we have seen for the last three years.

When looking at the market, the strongest measure professionals use is one we call the Absorption Rate, which is the rate at which homes are selling. That number is computed by dividing the number of homes on the market by the average number of sales per month for the past six months. Using that formula we have an absorption rate of 8.7 meaning that if no other homes were put on the market, it would take 8.7 months to sell the existing inventory. This absorption rate is the best we have seen in almost six years.

A market is said to be a Seller’s Market if the Absorption Rate is less than 5 months. The market is considered a normal market when the absorption rate is between 5 and 7 months and a Buyer’s Market if the rate is greater than 8 months. So while this is still a Buyers’ Market it is trending toward a normal market. This time last year the absorption rate was 13 months.

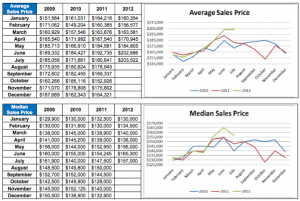

So what’s happening to prices? As you might expect this has had a favorable (from the Seller’s perspective) impact on prices. Whether using Average of Median Price as a measure (the median is a more appropriate measure in my opinion), the price of homes sold has risen. Be careful not to misinterpret this number. This does not mean that houses are selling for more… The actual price of properties is still declining but at a much slower rate than they have been. The anticipate decline for prices for 2012 in the Birmingham Metro market is between .5% to 1.5%, which is a significant improvement over the declines of the past two years which were in the 4-6% range.

A fourth and critical factor in the look forward is Housing Affordability. There is actually an index that measures this. NAR’s composite quarterly Housing Affordability Index rose to a record high of 205.9 in first quarter, based on the relationship between median home price, median family income and average mortgage interest rate. The higher the index, the greater the household purchasing power. This is the first time the quarterly index broke the 200 mark. Recordkeeping began in 1970.

Related to the Affordability index are the Mortgage Interest Rates which while they have had a recent up tick remain at near record lows.

Another factor creating increased demand is that of increasing rents. While homes are becoming increasingly affordable, rents continue to rise at a 5-10% rate.

These factors have been so positive that we have also seen a very noticeable increase in Home Construction Activity. In the Birmingham Metro Market there has been a 24% increase in new housing (single-family) starts as compared to the same period last year.

So what about foreclosures? Birmingham area’s foreclosure rate ranked No. 101 among 212 U.S. cities during the first half of 2012, according to RealtyTrac, a firm that tracks mortgage data across the nation. RealtyTrac counted 3,289 foreclosure filings in the metro area during the first six months, equal to one filing for every 152 household units in the area. The number of filings decreased by 7.2 percent from the same time frame in 2011. So the number of future foreclosures and other distressed properties available to buyers looks as though it will be on the decline.

So what does all this mean? If you’re a Seller this is great news… Even so, it will still be a while before we actually see home prices rise. At he present rate, I would expect that to occur about this time next year… Although, to be sure the rate of increase will be modest probably less than 1%. If you’re a Buyer, this may not be such great news… as you should expect prices to start a slow rise… But with home affordability as high as it is… it’s your early warning that the bottom of the market appears to be here… and may last for a year… But at the same time realize that shrinking inventories could make finding that perfect home just a bit more challenging. We are frequently seeing house sell before Buyers decide to pull the trigger on making an offer and increasingly, we are seeing multiple offer situations putting additional pressure on buyers.

Now having said all that, if you were to ask me tomorrow: “How’s the market?” I would respond as I have for the last five years: “That depends on which market you’re talking about!”

May the market be with you.