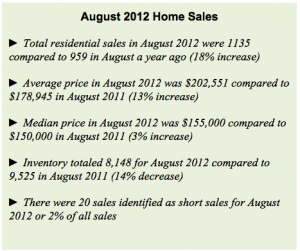

I begin with asking forgiveness for beating a drum loudly and often, but signs abound that the market improvement continues. Yes I know that was the focus of my last rather lengthy column. So what’s new to report… First of all is the continued upward trend of the market…. Especially our local market, the continuation of these positive trends is in of itself news and newsworthy.

In a recent interview with NPR, Robert Shiller, the legendary Yale economist who famously predicted the dotcom and housing bubbles, stated that he wouldn’t call the bottom of the market until he had seen 12 months of positive data… I can tell you that since last October in the Birmingham Market agents have been running at a pace not seen for more than 4 years. Without repeating (with updated charts) the charts from last month, all numbers are documenting an even tighter market… lower home inventory (homes on the market) and increased demand (homes sold). You have to go back to February of 2006 to find a time when we had less inventory on the market in Jefferson County.

Investors continue to be a heavy force in the market, as they snap up bargain priced properties especially in the eastern and western markets to either flip or put into the rental pool driven by the increasing rents being demanded by those profiting off of persons either unable or afraid to buy.

Multiple offers which had been much more unusual in the past several years are now becoming increasingly commonplace. Meaning we are seeing competition in the market place.

A new sub-division in Trussville has sold 18 homes in the last 4 months! That is almost the 12-month equivalent of what has been the strongest selling sub-division in the Trussville Market over the course of the last three years!

Developed / shovel ready lots have begun to move out of inventory… granted at much lower prices that that being paid in 2006… but the investment into real estate by the astute investor has definitely picked up steam.

Nay-sayers and others down on the real estate market, continue to discount this progress… Others, perhaps for political reason, don’t want to admit to any improvement of the market or general economy. You can buy into this tainted view or look at the facts. I personally believe facts outweigh dogma when it comes to investing or spending money.

Barbara Todara Realtor and blogger of Franklin, MA, reminds us:

“Buyers need to understand that buying a home is not like “day trading.” Buying a home is a “long term investment.” If one is planning on selling that home in a year, that homeowner will take a loss. If the new homeowner is thinking that he/she will be transferred within a short period of time, expect to take a loss.

If a homeowner has a resale home to sell, and that homeowner’s dream is to own a new home and live in it for decades, now is the time to make that happen. Resale homes are in demand in my area. We have a shortage of fresh inventory. Interest rates are incredibly low.

This is the time to buy a home that your family will live in for many years. This is the time to buy and settle in for the long haul. Real estate is a “long term investment” and the best time to invest is now with low prices and low interest rates. It’s a no brainer.”

Like so many who invest in the stock market buying when everyone is enthusiastic and selling when the bears show their claws and fangs, following the emotions of the market is no way to take advantage of the market.

I’m not known as a market cheerleader. But I am seeing evidence of a real change in the market regardless of the fear mongering of those talking about the fiscal cliff. I firmly believe the best buys will be made in the next 12 months. This is arriving much earlier than I originally thought possible.

May the market be with you.