The Real Story…

News and commentary about the real estate market and related topics.

Dave Parrish, ABR®, CRSA, CSP, GRI, ePRO®,REALTOR ®, RealtySouth

The opinions expressed here are my own and don’t necessarily represent those of HomeServices South.

Is Homeownership Still Worth It? (part 2)

Continuing our conversation from last week, I ended last week with what some might call a bit of a rant on the value of home ownership as an investment (if you missed that, be sure to visit my blog at www.DavidParrishRealtor.com/myblog ). As I said last week, the primary reason for home ownership isn’t for its value as an investment. But, more on that later… For the moment we are still going down the list of reasons given for why home ownership may not be worth it.

Reason number 2: Buying a house is really just renting. On its face that ‘s just a silly statement!

Regardless let’s take a look from the author’s point of view. If you rent a home you don’t pay for the upkeep of the home, or the taxes, or the insurance… without equity appreciation, you’re better off to have just rented. Really!

Do you feel it coming? Another rant from the Realtor ® and homeowner of not one but six homes during the past 40 years.

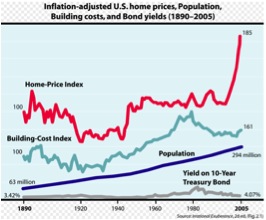

Let me begin with a request that we not forget history here. How many years have home values fallen versus how many years have they risen. Markets run in cycles… The housing market is no exception. We are experiencing a market correction following a totally unrealistic period of growth. The sky is not falling … Chicken Little… No, it’s not the time to sell; unless, you have no other options or you’re planning on moving up and taking advantage of bigger savings on your purchase than the losses incurred on your sale.

I bought my first home in 1970. Moved from an apartment in East Lake (77th Street and 5th Ave North) where I was paying $75 a month rent. I bought a new home in Pinson on Oak Lane for $27,500 my monthly payment was $135 a month if I remember correctly. I sold that home in 1974 for $55,000 (less the Realtor ® commission, which I gladly paid!)… Nice little profit… but we were in a period of double-digit inflation, 10% interest rates for a 30 year mortgage and the expectation of at least a 10% annual pay increase for acceptable performance. Yea, yea it was a different day… but I don’t see many people wanting to go back.

Back to the author’s point of view. I was looking at property in that very same neighborhood just last year. The property we were looking at sold for $106,000. One of those homes is on the market today for $159,900. Probably a little high… The indicated market price would be more on the order of $140,000 to $150,000 tops.

There are at least 4 families living in that neighborhood today that lived there when I did. Assuming that they did not refinance or use their homes as a piggy bank, those homes have been mortgage-free for 10 years now. Yes they still have to pay taxes $600-$700 per year and I’m betting they’re paying for homeowners insurance another $700 per year. So their monthly housing expense (rent if you will) would be around $120 per month plus maintenance.

If you were to rent a home in that neighborhood today, it would cost you between $800 and $900 a month. If you purchased a home in that neighborhood your monthly payments would be between $600-650 per month including taxes and insurance. Oh by the way, the same apartment in East Lake that I was paying $75 a month for now rents for $400 a month. You see rents are not frozen in time. And landlords don’t rent without taking in consideration those same taxes and insurance the author says the renter need not be concerned with. Really… so who do you think pays them? Believe me, those expenses are part of the rent… a portion for which the owner receives a tax deduction… not the renter.

You’ll note that none of these numbers reflect the tax advantage experienced over time by those homeowners while they were paying for their homes. Not inconsequential during the early years of a mortgage. Yes this is a form of subsidized housing! I hear the shouts of communism and socialism echoing in the hallways!

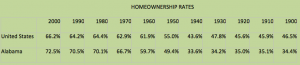

Introduced with the Income Tax in 1913, the Mortgage Interest Tax Deduction was introduced for a number of reasons… First for political reason… We Americans have always hated the idea of being taxed… so it was a way of appeasing the masses by at least exempting some income from the tax burden. But there was more than just that effort to ease the burden on the common man… Oh by the way in 1913 home ownership rates were rather dismal.

There is this principal of “Enlightened Selfishness / Self Interest” at work here. Those with a vested interest in the status quo are more likely to support the status quo… Involvement and inclusion are antidotes for anarchy… thus the building of a middle class.

The “American Dream” is many things… it is something different for everyone… But when you survey Americans about their American Dream and really think about their responses you see the common thread of independence… and self-reliance. Not being at the mercy of a landlord by owning your own home is a common expression of the American Dream… a step toward economic independence and control of our destiny.

So is renting the same thing as buying… I really don’t think so… What about you?

I’ll do my best to wrap this discussion up next week, until then…

May the Market be with you.