The Real Story…

News and commentary about the real estate market and related topics.

Dave Parrish, ABR ®, CRSA, CSP, GRI, ePRO ®, REALTOR ® RealtySouth

The opinions expressed here are my own and don’t necessarily represent those of HomeServices South.

Is Homeownership Still Worth It?

I was in the dentist office first of the week and while waiting to be seen, I spotted in the magazine rack across the room a weekly news magazine with the headline… “Rethinking Home Ownership: Why owning a home may no longer make economic sense.”

You know I had to pick that one up and read! Always interested in hearing an opposing view!

So where to begin… First the arguments posed against home ownership:

- Stock Market averages a better return over time than an equal investment in the housing market.

- Buying a house is really just renting.

- Today’s generation is nomadic, owning a home is for many just an unwanted anchor.

- If you can’t sell it, it’s not an investment.

In fear of going way too long here, I’ll try to be succinct and to the point.

First a confession, not only as a Realtor ® but as a homeowner who has benefited from homeownership multiple times, I am biased here. My experience in both the stock market and the housing market yells out… What we see here is a collection of half-truths.

- Image via Wikipedia

While I disagree that the primary reason to own your home is for investment purposes… I do acknowledge that it is not a reason to be ignored. So let’s take a look at the Real Story when it comes to real estate as an investment opportunity.

Unless you’re buying on margins (generally a proven path to disaster for the uninitiated or those of the working class) you will be unable to make a leveraged investment in almost any investment instrument other than real estate. That means that to participate in an investment you must first have money to invest! Most Americans do not have a sufficient surplus of funds to become involved in investing in any other fashion than via real estate… that is by way of home ownership.

While it is actually possible to buy for zero down in some situations, let’s stay with the more conservative scenario available to most buyers. With the purchase of a home the average buyer can control an asset with as little as 3.5-5% of the value of the home. For example a $100,000 asset can be controlled with as little as $3500 – $5000. Now it is true that if the home’s value does not appreciate (increase) there will no be no return and actually a loss that is also leveraged could be experienced. So buying wisely is of huge importance… just as it is when investing in the stock market. One of the many reasons a buyer should not purchase without the use of a trained and experienced professional (end of commercial).

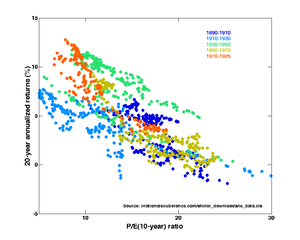

As with all investments, markets run in cycles. There are times to buy and times to sell. Market timing has always been problematic regardless of the market you’re dealing in. Let me tell you about my 20,000 shares of Bruno’s stock… or perhaps you would like to tell me about your 401k. Seems that we only know when the best time to do buy or sell is when the peak opportunity has already passed… again true with all markets.

I will say that short-range investments tend to be riskier and do require greater expertise to be profitable. The average homeowner will have a difficult time recouping their costs/investment in periods less than about five-to-seven years, due to the fees associated with acquiring and selling. Although, I know folks going against the grain of the prevailing logic and making quite a nice living flipping homes… still. There are of course exceptions to every rule… But here we want to deal with the normal experience.

When housing values were at their peak about 4 years ago… The same experts who are now telling us to reconsider our view of home ownership were pushing the housing market… In a seller’s market where prices were increasing around 10% a year at terms favorable to sellers not buyers! Only a few voices were urging caution.

I don’t know about you; but, Warren Buffett and I agree: buying low and selling high are proven ways to make a profit. Housing prices in our market are down an average of 15-20% from 2006 prices in most neighborhoods… Are they as low as they will go… probably not!

My read, based on near constant study, is that we will bottom out somewhere between mid 2012 to mid 2013. But, neither you nor I will know that we’ve bottomed out until the bottom has passed and prices are on the rise. So basing your decision on being at the bottom of the market will always be a gamble.

What should be equally considered are the other costs associated with the investment. Chief among these are the cost of money… that is the interest rate you will pay for the leveraged portion of your investment otherwise known as the mortgage. Today’s rates are at historical lows. The Fed has said they will hold the line for a while… probably through the end of the first quarter of 2011.

As an investor you’ll want to parlay these two factors to your advantage to get the real best deal!

Admittedly the following is anecdotal… But I’ll remind you that I’m no Warren Buffet and I have been successful in real estate investment… Just to cite one example… I purchased a rental property in 1995 for $38,000… It took a $4000 investment and some guts to get started. Over time, we’ve made $17,000 in repairs/improvements and paid the house off. It currently would appraise for $150,000 down from the $185k it would have brought three years ago… Have I lost $35,000? Or have I made $95,000. Truth is neither! I won’t know what I’ve made or lost until I sell it. But until then I‘ll just keep depositing those $750 rental checks each month!

We’ll continue this discussion next week… until then…

May the Market be with you.

Related articles by Zemanta

- The Scam Of Homeownership (realestateradiousa.com)